Articles

First home buyers turn to Bank of Nan and Pop

Nan and Pop have always been good for birthday money, but one-in-10 grandparents are taking their generosity to the next

What you should know before buying ‘subject to finance’

Not sure if you’ll get the thumbs up for a home loan? But you really, really like that house that

Not feeling the budget love? 4 ways you could still get ahead

If the latest federal government budget is leaving you hungry for perks and savings, you’re not alone. We’ve had a

Low deposit scheme helps over 150,000 families buy sooner

Whether you’re rat running your local streets, or have a knack for always picking the fast-moving supermarket queue – everyone

Here’s why your borrowing power might soon get a lift

Who doesn’t love a tax cut? Most of us are now only weeks away from saving on our tax bills,

How to know if you’re paying a fair price

We all love the idea of nabbing a bargain property, but for most home buyers the real issue is whether

Can you remember your home loan interest rate?

Where you put your car keys, who won the footy premiership three years back, the new prime minister of New

Plot twist: Millennials are Australia’s most active property investors

When it comes to buying investment properties, younger Australians are punching above their weight, with Millennials taking the title as

Homeowners now an extra $71,000 richer (on average!)

You may not feel richer, but if you’re a homeowner, there’s a decent chance your personal wealth has surged over

FOMO, FOBO and FOOP – how they can hold you back

Nobody likes missing out on a good thing. But then again, who likes overpaying? So how do you strike the

Explainer: how construction loans work

There’s something very special about moving into a newly built home or putting the finishing touches on a major renovation.

Why offset accounts are hitting new highs

Spare cash can be tight right now (cost of living crunch, anyone?). But if you’ve still got some savings plus

How long does it really take to get a home loan?

Need a home loan in a hurry? You could be in luck. Plenty of lenders are keen to crunch loan

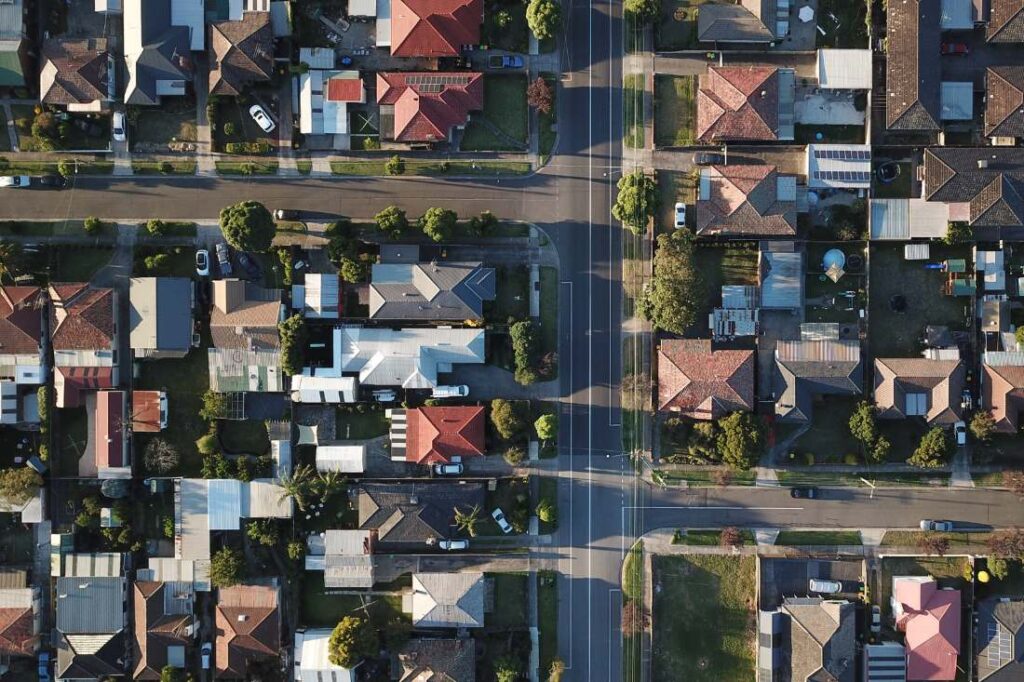

Where are the bargain homes located in your suburb?

Location may be a big driver of property prices, but in any given suburb a few streets can be all

Home buyers rejoice! More listings are hitting the market

Great news for home buyers! After an extended run of low listings, the number of homes coming onto the market

They’re back! Why property investors account for one-in-three new home loans

Lending to property investors is soaring once again. We lift the lid on what’s driving investor interest – and what

When will the next RBA cash rate call be made?

Happy days! The Reserve Bank kept rates steady in February. But a shake-up in the number of times our central

4 tips for self-employed home loan applications

Applying for a mortgage when you’re self-employed may have you jumping through more hoops. But it needn’t deter you from

First home buyers charge back into the market

Hats off to Australia’s first home buyers! The latest lending data shows they’re refusing to let last year’s rate hikes

How your deposit size can shape the rate you pay

It’s commonly known that the bigger your deposit, the smaller your home loan, and thus, the lower your monthly repayments.

The pros of having a mortgage broker on your side

What exactly can a mortgage broker do for you? Well, we don’t mean to toot our own horn, but we

5 New Year’s resolutions for your home loan

Thought of a New Year’s resolution yet? Or perhaps you’ve broken one already? Either way, check out our list of

Merry Christmas! Season’s greetings from all of us to you

The year has flown past, and as our thoughts turn to trees, tinsel and turkey, we’d like to thank all

Ho ho ho! The smart move that has 1 in 10 borrowers feeling jolly

Home owners have been battling rising interest rates for over a year and a half now. But a new report

What’s tipped for house prices in 2024?

If buying a home is at the top of your wish list for 2024, don’t miss our rundown on how

More lenders sign up to low deposit first home buyer scheme

First home buyers with a small deposit now have an even wider range of lenders to choose from. We reveal

How to manage your home loan over Christmas

It may be called the silly season but a few smart strategies could help you enjoy the festive season this

The big stretch: should you extend your loan term?

If the November rate hike will seriously stretch your finances, one potential solution may be to extend your loan term.

RBA increases the cash rate by 25 basis points, up to 4.35%

The Reserve Bank of Australia (RBA) has increased the official cash rate by 25 basis points, taking it to 4.35%.

Brokers help settle a record 7-in-10 new mortgages

Mortgage brokers have notched up a new personal best, with seven out of every 10 new mortgages settled thanks to

Revealed: the four cities tipped to be future property hotspots

No matter whether you’re in the market for a home or an investment property, it makes financial sense to buy

How much can you really save by refinancing?

Not sure what refinancing is all about? You’re not alone. Our quick explainer lets you master the basics and helps

One-in-three first home buyers use guarantee schemes

Know anyone who wants to buy their first home? A new report confirms that low deposit schemes are getting younger